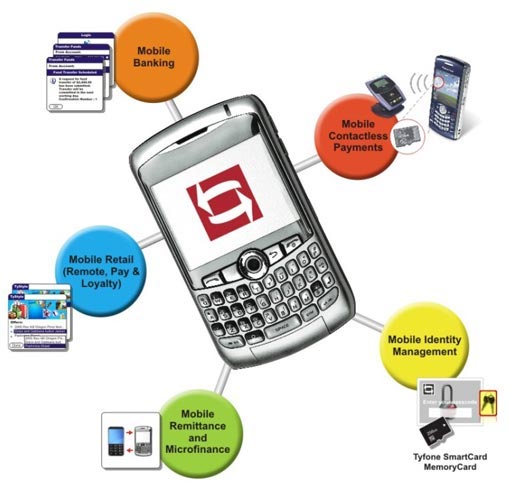

A mobile phone is no longer a simple device to make calls; rather it has become the hub for all your activities, from e-mailing and browsing to paying bills and transferring money.

Mobile banking (also known as M-Banking, m banking) is a term used for performing balance checks, account transactions, payments, credit applications and other banking transactions through a mobile device such as a mobile phone or Personal Digital Assistant (PDA) . The earliest mobile banking services were offered over SMS, a service known as SMS banking . With the introduction of the first primitive smart phones with WAP support enabling the use of the mobile web in 1999, the first European banks started to offer mobile banking on this platform to their customers.

Mobile banking is kind of like what roller skates were to kids in the 1950s: Many want to try it, but the risk of looking silly is pretty high, and the chance of getting hurt is pretty real. Not too worry; there are ways to make your mobile banking app work for you. But consumers can often take matters into their own hands and improve their mobile banking experience.

But one has to be extra careful while using such services, we are mentioning some excellent points that should never be neglected.

Banking on the Move - You can easily access any mobile banking apps and other apps , but make sure you’re near a secure Wi-Fi connection.

Official Apps - Nearly every bank in today’s era has their own official mobile banking apps on the Google Playstore. Be it Lloyds, Barclays, HSBC or Natwest, and many more. Generally, these apps have similar features and similar level of security features.

Sign up for your bank’s text programs

you can often get your bank’s best rate deals in one simple step: Sign up for your bank’s text service. Not only can you get personalized, real-time messages on your account (such as low balances and potential late payment issues), you can also be among the first to hear about a great certificate of deposit rate or credit card deal).

Don’t risks a security breach

The No. 1 concern among bank customers about mobile banking is security - and with good reason. There are scam artists out there who will try to lure you into signing up for your “bank’s” mobile banking platform, only to give you a fake app or website that has nothing to do with your actual bank. Never, ever sign up for a bank’s mobile banking app without checking with them first. Almost always, the best way to go is through a secure sign-up feature on your bank’s website, or via a mobile app on your cell phone downloaded straight from your bank. Never sign up through an unsolicited phone call or email. When you do sign up, make sure your password is protected by a “three strikes and you’re out” feature. Most cell phones have a “tools” or “security” application where you can set password limits on sensitive accounts. Limit your bank password entries to three to thwart potential cyber thieves.

Security is Paramount - To protect their customers from malware mobile banking apps have introduced a plethora of stringent security precautions. Some of them ask you to create unique PIN or answer for a security question.

Help the Environment - You can stop using paper for every month statements as mobile banking apps gives you the feature of sending your statements on a monthly basis. You just need to set the app to send a run-through of your monthly statements.

Banking with PayPal - These mobile banking apps gives you an instant way of linking to your PayPal and western union accounts to transfer money to all over the world. You can instantly pay for your purchase.

Be Extra Wary of Third-Party Apps - Beware of using third-party mobile apps on your smartphone. Any such apps are dangerous for you to use.

Checking Permissions - The best way of finding potential dangers with third-party apps is to examine the app’s permission when looking to download them.

Google Wallet - Google wallet makes it easier for you to pay for goods. Google’s contactlesspayment system allows you to pay for your purchase through your phone.

Ongoing Payments -You can easily set up a direct debit to a different account, or create a standing order through your Android device. You can edit and remove them through internet banking service, within a branch itself.

Beyond your Accounts - Some other features of Mobile banking apps include information about nearest ATM and branch, as well as opening hours, information on new accounts, loans and mortgages. Some include details on key contacts of the bank whom you can contact regarding your account problem.

Keep above points in mind and Have safe mobile banking….